Chi

Home »Lithium Prices Rebound After Chile Earthquake

Summary

China’s lithium prices went up on Friday after a strong earthquake hit Chile, a key lithium-producing region. The earthquake caused concerns about the lithium supply, which is essential for electric vehicle (EV) batteries. However, worries about future demand for EVs also affected lithium prices.

Lithium Price Surge

On Friday, the most-traded lithium carbonate futures on the Guangzhou Futures Exchange increased by 2.9%, reaching 89,800 yuan ($12,356.89) per metric ton. This rise came after prices had dropped to a seven-month low of 86,450 yuan in the previous session.

Earthquake Impact

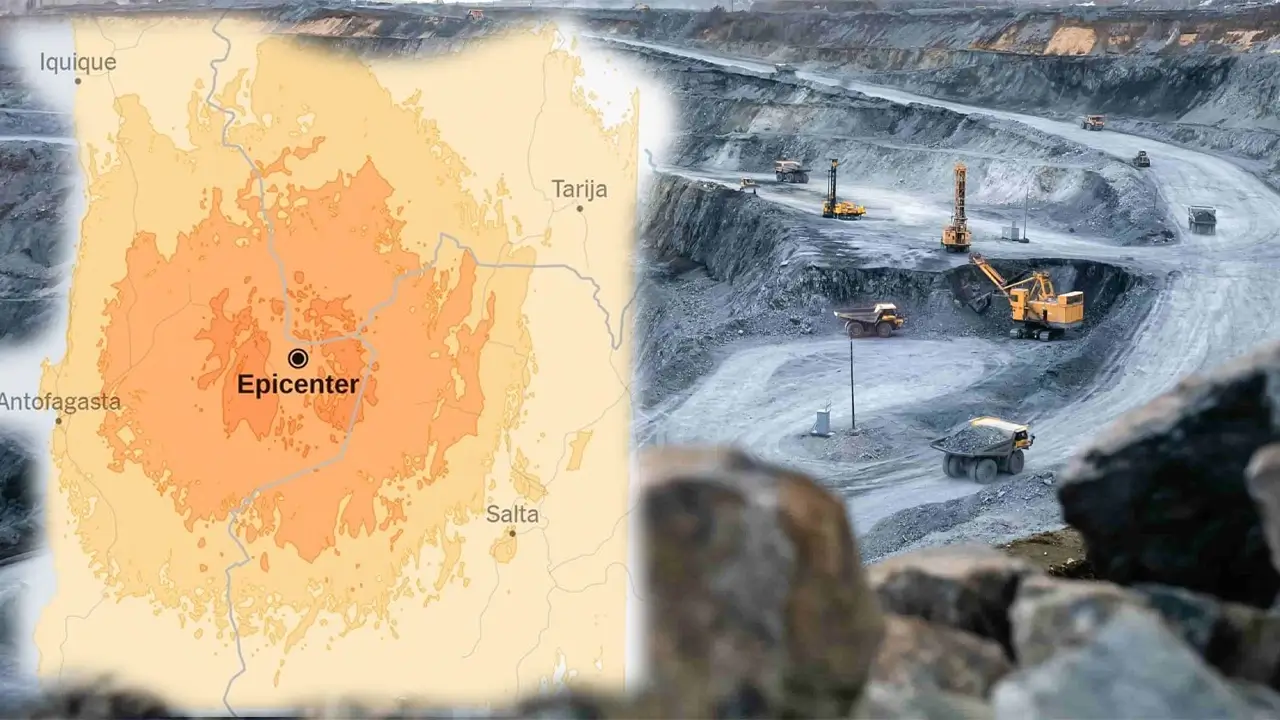

A powerful 7.3-magnitude earthquake struck northern Chile, which holds the largest lithium reserves in the world. About 90% of these reserves are in the Atacama desert, close to the earthquake’s epicenter. This event caused supply fears because Chile is a major supplier of lithium chemicals to China.

Market Reactions

Investors responded to the news by raising concerns about the future of EVs, especially with the upcoming U.S. presidential election. Some believe that if Donald Trump wins, his policies might not favor EVs as much as the current administration. This has added to the already existing concerns about lower-than-expected EV sales in the U.S. and Europe.

EV Sales Trends

In Europe, sales of fully electric and plug-in hybrid vehicles dropped by 7% in June. Meanwhile, in the U.S. and Canada, sales grew by 6%. Analysts at Macquarie expect that EV sales growth in China will slow down from 30.2% last year to 24.6% this year.

Surplus and Production

China’s lithium carbonate production surged by 57.4% in the first half of this year, reaching 303,200 tons. This increase in supply has pushed prices down. However, producers might reduce output in August due to recent price drops affecting their profit margins.

- Audi GT50 Concept: A Loud Reminder of Why Car Enthusiasts Fell in Love With Audi

- Nearly 30% of UK Drivers Believe Car Tax Should Be Based on Mileage — Survey

- Why Planes and Boats Escaped the Luxury Tax But Cars Didn’t

- Australia’s Headlight Confusion: Authorities Warn Drivers After Viral $250 Headlight Rule Goes Wild Online

- 2025 Hyundai Venue Facelift Launched in India – Full Details, Variants, and Price

Future Outlook

According to a forecast by CRU, there will be a global surplus of 90,000 tons of lithium carbonate equivalent this year. Chinese producers Ganfeng Lithium and Tianqi Lithium have already warned of potential losses for the first half of this year due to falling lithium product prices.

Conclusion

The recent earthquake in Chile has caused a temporary spike in lithium prices due to supply concerns. However, ongoing issues with EV demand and increasing lithium production continue to impact the market. The future of lithium prices will depend on various factors, including production levels and global EV sales trends.

Sources